The United Arab Emirates (UAE) boasts a robust and dynamic business environment, but with the advantages come regulatory responsibilities. One such critical aspect for businesses operating in the UAE is excise tax compliance. This comprehensive guide combines the expertise of Alliance Prime, a leading accounting and tax consultancy in the UAE, with key insights into excise tax laws to help businesses navigate this complex terrain effectively.

Excise Tax in UAE: Understanding the Basics of Indirect Tax

Excise tax, an indirect tax, was introduced in the UAE in 2017. Its primary aim is to deter the consumption of goods that are harmful to human health or the environment. The goods currently subjected to excise tax in the UAE include carbonated drinks, tobacco products, energy drinks, electronic smoking devices, and liquids, and products with added sugar or sweeteners. The tax rates vary based on the nature of the goods, with rates like 50% for carbonated drinks and 100% for tobacco products.

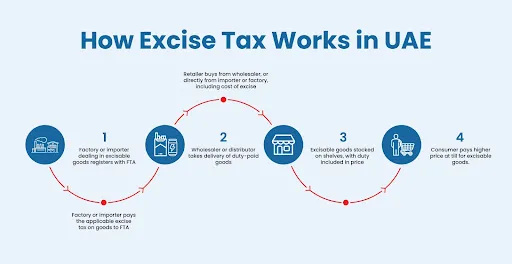

Excise tax is levied on the importer, producer, or stockpiler of excise goods in the UAE. The tax calculation is based on the value of the goods at the time of release for consumption. The payment can be done through two schemes: monthly payments, where taxpayers file a monthly excise tax return and pay the due tax within 15 days of the period end, or quarterly payments, requiring taxpayers to file quarterly returns and pay the due tax within 30 days of the period end.

Registering for excise tax in the United Arab Emirates (UAE) is a crucial step for businesses looking to comply with the country’s tax laws. As of my last knowledge update in January 2022, the UAE imposes excise tax on specific goods, such as tobacco, energy drinks, and carbonated beverages. To navigate this process seamlessly, businesses can refer to official resources like the Federal Tax Authority (FTA) website, where they can find comprehensive information on registration procedures and compliance requirements.

According to statistics from the FTA, a significant number of businesses have successfully registered for excise tax since its introduction. Accessing the latest data and guidelines is essential for staying abreast of any regulatory changes. For the most up-to-date information and assistance, businesses can explore the FTA’s dedicated portal on excise tax registration: FTA Excise Tax Registration Portal. It serves as a valuable resource to ensure that businesses adhere to the UAE’s excise tax laws and operate within the legal framework.

Responsibilities of Excise Taxpayers

Excise taxpayers in the UAE bear several responsibilities, including registration with the Federal Tax Authority (FTA), filing tax returns on a monthly or quarterly basis, timely payment of excise tax, and maintaining accurate records of all excisable goods.

How Excise Tax Consultants Facilitate Compliance

Given the complexity of excise tax compliance, businesses often turn to excise tax consultants for guidance. Alliance Prime, as a prominent accounting and tax consultancy in the UAE, provides a range of services to assist businesses in meeting their excise tax obligations. These services include excise tax registration, filing returns, calculating tax liability, record-keeping, dealing with the FTA, and managing excise tax risks.

Benefits of Using Excise Tax Consultants

The advantages of engaging excise tax consultants are manifold. They help in reducing the risk of non-compliance, ensuring businesses meet all excise tax obligations and avoid penalties. Excise tax consultants provide peace of mind by handling the intricate aspects of compliance, allowing businesses to focus on core operations. Their expertise also extends to offering valuable advice on various aspects of excise tax compliance.

Who Should Register for Excise Tax?

Excise tax registration is mandatory for businesses involved in importing excise goods, producing or manufacturing excise goods released for consumption in the UAE, stockpiling excise goods, and overseeing excise warehouses or designated zones. The FTA provides support and guidance, and non-compliance can result in penalties and fines.

Exemptions for Excise Tax Registration

For those not regularly importing excise goods, exemptions from registration may apply. However, even if exempt, businesses might still be required to pay excise tax on goods exceeding the duty-free threshold. It’s crucial to understand these nuances to ensure compliance.

How to Comply with Excise Tax Laws in UAE

For businesses aiming to comply with excise tax laws in the UAE, a strategic approach is crucial. Consultants like Alliance Prime excel not only in ensuring compliance but in providing comprehensive services that go beyond the basics. From excise tax registration to ongoing advisory support, excise tax consultants offer a holistic solution.

Key Steps for Compliance

This section outlines key steps businesses can take to ensure excise tax compliance:

- Registration with FTA: Initiate the compliance journey by registering with the FTA. Excise tax consultants guide businesses through this process, ensuring accurate and timely completion.

- Examine Business Activities: Understand the scope of excise tax by identifying specific business activities that require compliance. Excise consultants conduct a thorough analysis to pinpoint areas needing attention.

- Comprehensive Record-Keeping: Maintain meticulous records of excisable goods. Excise tax consultants assist in establishing robust record-keeping systems, ensuring transparency and accuracy.

- Audit Preparedness: Prepare for potential FTA audits by conducting internal audits. Excise consultants provide audit support, identifying and rectifying compliance issues.

- Timely Filing of Returns: File excise tax returns on time to avoid penalties. Excise tax consultants offer assistance in filing returns within stipulated time frames.

- Stay Informed About Changes: Stay abreast of regulatory changes to ensure ongoing compliance. Excise consultants provide advisory services, keeping businesses updated on the latest developments.

Additional Tips for Businesses

In addition to excise tax specifics, businesses are advised to keep accurate records of excisable goods, regularly review compliance procedures, and seek professional advice from excise tax consultants if needed. By following these tips, businesses can enhance their excise tax compliance and avoid potential penalties or interest charges.

Your Trusted Excise Tax Partner in UAE

Alliance Prime stands out as a trusted excise tax partner in the UAE. Their team of experienced excise tax consultants assists businesses in excise tax compliance, from registration to ongoing advisory services. The consultants ensure businesses stay abreast of regulatory changes and provide expert guidance on adapting to evolving tax laws.

Conclusion

Navigating excise tax compliance in the UAE demands not just adherence to regulations but a strategic and proactive approach. Excise tax consultants emerge not only as a guide for compliance but as a comprehensive partner, offering services that extend beyond the essentials. For businesses seeking not only excise tax compliance but a trusted partner for their overall tax and financial needs, tax consultants such as Alliance Prime stand ready to deliver. If you are still confused about how to register for excise tax in the UAE, feel free to contact the excise tax consultants in UAE.