The UAE’s carefully controlled tax structure makes Value Added Tax (VAT) vital to a business’s finances. Understanding and completing VAT return filing is a legal necessity and a critical step in financial health for any organisation. Incorrect VAT filings may result in fines and audits that damage your business’s reputation and cash flow.

This basic, step-by-step guide will help you file VAT return correctly. Mastering this technique will assist company owners and accountants in complying with the Federal Tax Authority (FTA) and prevent expensive blunders. Stay tuned as we explain each step to help you submit VAT returns confidently.

What is VAT?

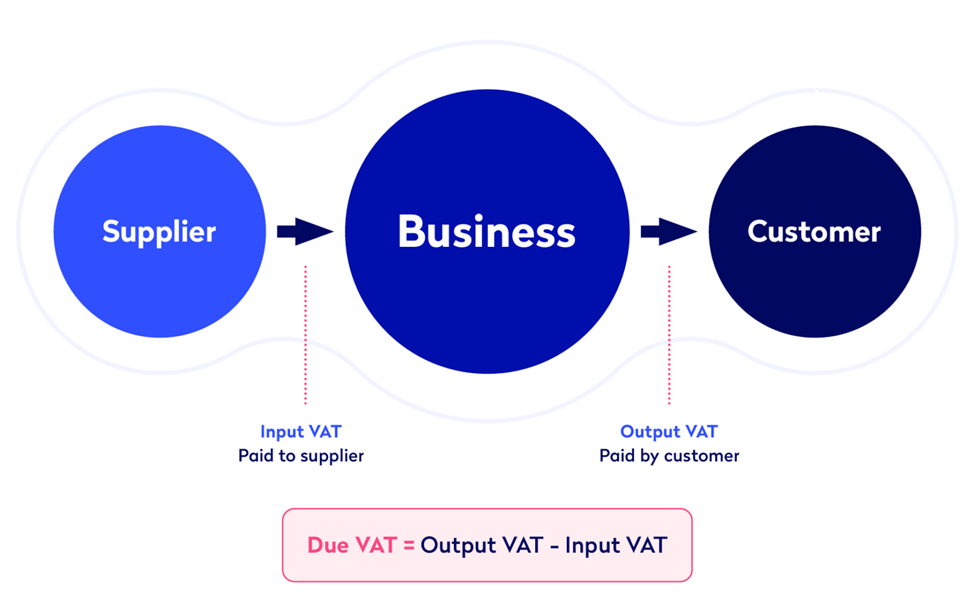

Value Added Tax (VAT) is a consumption tax on products and services at each step of production or delivery. When a firm sells products or services, it passes on the tax to the customer. Many nations, like the UAE, charge VAT as a percentage of the selling price.

VAT taxes the difference between sales taxes and purchase taxes for companies. Businesses may demand VAT refunds from tax authorities if they paid more VAT on purchases than sales.

VAT is crucial to the UAE government’s revenue generation and diversification away from oil. To avoid Federal Tax Authority fines and collect VAT, businesses must follow VAT laws.

Why Accurate VAT Filing is Crucial?

UAE firms must file VAT accurately, not merely for good practice. Incorrect VAT files may result in fines, penalties, or even criminal accusations. The Federal Tax Authority (FTA) enforces VAT compliance, and tax return disparities may lead to audits and investigations.

Failure to complete VAT returns properly might potentially have serious financial consequences. Late filings, underreporting tax liabilities, and inaccurate data result in an FTA penalty. These fines might swiftly drain your company’s finances. Repeated VAT reporting mistakes might lead to greater fines or legal action against the firm.

Besides financial loss, improper VAT filings may ruin your business’s image. It may damage your business’s reputation and compliance with local tax laws with customers, partners, and investors. Continuous FTA noncompliance may cost companies opportunities and slow development.

By reporting VAT correctly and on time, you avoid expensive fines and preserve a good company reputation, providing you peace of mind and the flexibility to concentrate on development and success.

Understanding VAT Returns

Companies must submit VAT returns to disclose the VAT they charged on sales and paid on purchases. These returns inform the Federal Tax Authority (FTA) about your business’s VAT activity, enabling them pay the proper amount. A VAT return reconciles what your firm owes or owes the government based on its VAT transactions over a period.

VAT return types vary by company filing frequency. Most UAE firms must file VAT returns monthly or quarterly, depending on taxable revenue. Larger companies that do a lot of business may file reports every month, while smaller companies may file reports every three months.

The FTA’s web portal simplifies the VAT submission process. Businesses may log onto the site, input sales and purchase information, and submit their return to the FTA. This digital VAT filing method is simpler, quicker, and more efficient. To avoid mistakes and fines, you must carefully analyze and check all of your effort before submitting it in.

Step-by-Step Guide to Filing VAT Returns

1. Gather Required Documentation

Before you fill out your VAT returns, you’ve to make sure that all of your necessary documents are accurate. This includes:

- Invoices: Get all sales invoices, including VAT. These should clearly show transaction data and VAT.

- Receipts and Tax Documents: Collect receipts from purchases of products and services that have VAT already paid for them. Include clear information about VAT amounts in these slips.

- Bank Statements and Payment Records: Use bank statements and payment records to verify VAT activities across payments and receipts. All records should show real money coming in and going out. Sort these documents by date and type to make filing for VAT easier. Classify sales and purchase transactions by taxable, exempt, or zero-rated products in distinct files. This clarifies VAT due and refundable calculations. A well-organised record-keeping system simplifies VAT filing and protects your firm against FTA audits.

2. Calculate VAT Payable

Calculate VAT for the tax period after collecting all documents. This includes two crucial calculations:

- VAT on Sales (Output Tax): Your customers pay this VAT on purchases. The UAE VAT rate is 5%; therefore, double the selling price by that.

- VAT on Purchases (Input Tax): The charge for products or services acquired for your firm. Purchase invoices usually reflect VAT.

To calculate VAT, subtract input tax from output tax. If your firm paid more VAT on purchases than sales, the FTA may reimburse you.

You must differentiate between VAT-exempt and VAT-taxable goods/services. This helps you calculate correctly.

3. Review VAT Payments and Credits

Check the VAT credits and payments to make sure you collect the right amount. Follow these steps:

- VAT Paid on Expenses: Make sure you are VAT-crediting the appropriate company costs. It is possible to claim VAT back on office materials, energy, and other business purchases. Do not make claim mistakes by not including all costs needed for the business to run.

- Bad Debts and Refunds: Follow the VAT paid on sales that have not been paid for or are marked as bad debts. You might need to remove bad debts from your VAT return if you have already paid VAT on them. Bad debt changes keep you from having to pay too much VAT under the FTA.

Check all records for missing transactions or VAT credits, since this might affect your VAT return and refund.

4. Complete the VAT Return Form

The VAT return form is available after collecting your documents and computing your VAT. Businesses may file VAT returns online via the FTA.

- Accessing Form: Enter your FTA credentials and go to the VAT refund section. In addition, select monthly or quarterly filing and open the VAT return form.

- Filling Out the Form: Enter amounts for output tax, input tax, and VAT payable/refundable. Refer to your manual to complete all fields correctly.

- Common Mistakes: Do not do things wrong, like using the wrong VAT rates, putting the wrong labels on your sales and purchases, or not having any bills. However, these mistakes could lead to problems, reports, and fines.

5. Verify and Submit the Return

Before filing your VAT return, check all information:

- Verify Calculations: Check that the amounts you calculated for VAT are correct. Furthermore, check the VAT amounts and rates again.

- Cross-Reference Documents: Verify figures in the return against invoices, receipts, and statements.

After reviewing everything, click submit on the FTA site. The FTA will submit your VAT return and provide you with a receipt. To avoid late filing penalties, file the return on time. To avoid penalties, pay VAT before the deadline.

Common Mistakes to Avoid While Filing VAT Returns

VAT returns are complicated, and even slight errors might result in fines or audits. Here are some typical mistakes to avoid while filing your return:

1: Missing or Incorrect Invoices

Common blunders include missing or inaccurate invoices, such as missing sales and purchase invoices or entering incorrect facts. If you miss an invoice, you might report less than or more than the correct amount of sales or purchases on your VAT return. Make sure all invoices account for VAT and reflect it.

2: Miscalculating VAT Payable or Refundable

Calculation mistakes are common while handling several transactions. Double-check your sales and purchase VAT figures. Small mistakes might cause big differences and costly penalties.

3: Failure to Report Exempt or Zero-Rated Supplies

In the UAE, some products and services are VAT-exempt or subject to zero tax. Not categorising items appropriately in your VAT return might result in noncompliance. Report sales and purchases of exempt or zero-rated products appropriately.

4: Not Submitting on Time

Failure to submit VAT returns on time may result in fines. You must file your return on time to avoid penalties. Set reminders to submit taxes and pay on time to be compliant.

Simplify Your VAT Filing Process with Alliance Prime

Alliance Prime Accounting & Tax Consultancy UAE knows VAT compliance may be complicated and time-consuming for companies. Our skilled accountants and tax experts will help you register, file, and comply with VAT properly and effectively.

Our VAT consultancy services include VAT registration, VAT returns, and VAT planning. Alliance’s knowledge of UAE tax laws and changes to regulations means that VAT returns are always correct and on time, which lowers the risk of fines or audits.

We handle your VAT tasks professionally, giving you peace of mind. Alliance Prime Accounting and Tax Consultancy UAE will help you avoid expensive errors and remain compliant. Get experienced VAT advice and help for your company now.

Conclusion

VAT reporting accuracy is crucial for UAE tax compliance and penalty avoidance. You may avoid audits and penalties by keeping accurate records, computations, and deadlines. For seamless filing, keep organised and up-to-date on tax laws. If you are uncertain or overwhelmed, expert advice may make all the difference. Our VAT return experts at Alliance Prime Accounting and Tax Consultancy UAE help you submit swiftly and properly. Contact us for VAT management ease.